2024 year in review: The Opto platform

Opto: Transforming private markets for wealth management firms

At Opto, our goal is to build the technology infrastructure that transforms the way wealth management firms access private markets on behalf of their clients. We’ve made huge strides this year—thanks to our partners—but we’re just getting started with fixing a broken private markets investing process.

In 2024, we worked with our RIA partners to create and deploy bespoke private investing programs within their firms. Looking back, I’m extremely proud of what our product development teams have accomplished and humbled by how much we’ve learned from our partners along the way.

An analytical foundation for private markets

One of the core problems facing investors in private markets is a lack of good data and analytical frameworks to help make investment decisions. Time and again, our partners have highlighted the difficulty of:

- Sizing private allocations

- Determining their composition

- Understanding their potential impact on clients’ ability to meet their long-term goals

The next step—selecting the right investments—is equally data-poor. This makes it hard to determine whether a fund manager has a durable edge (and where it comes from) or how a given investment compares to others.

In the past year, our engineering team has developed:

- Key data systems

- Portfolio construction models

- Evaluation frameworks for private assets

With this analytical foundation in place, we’ve enabled our partners to unlock the potential of private markets for their clients in compelling new ways.

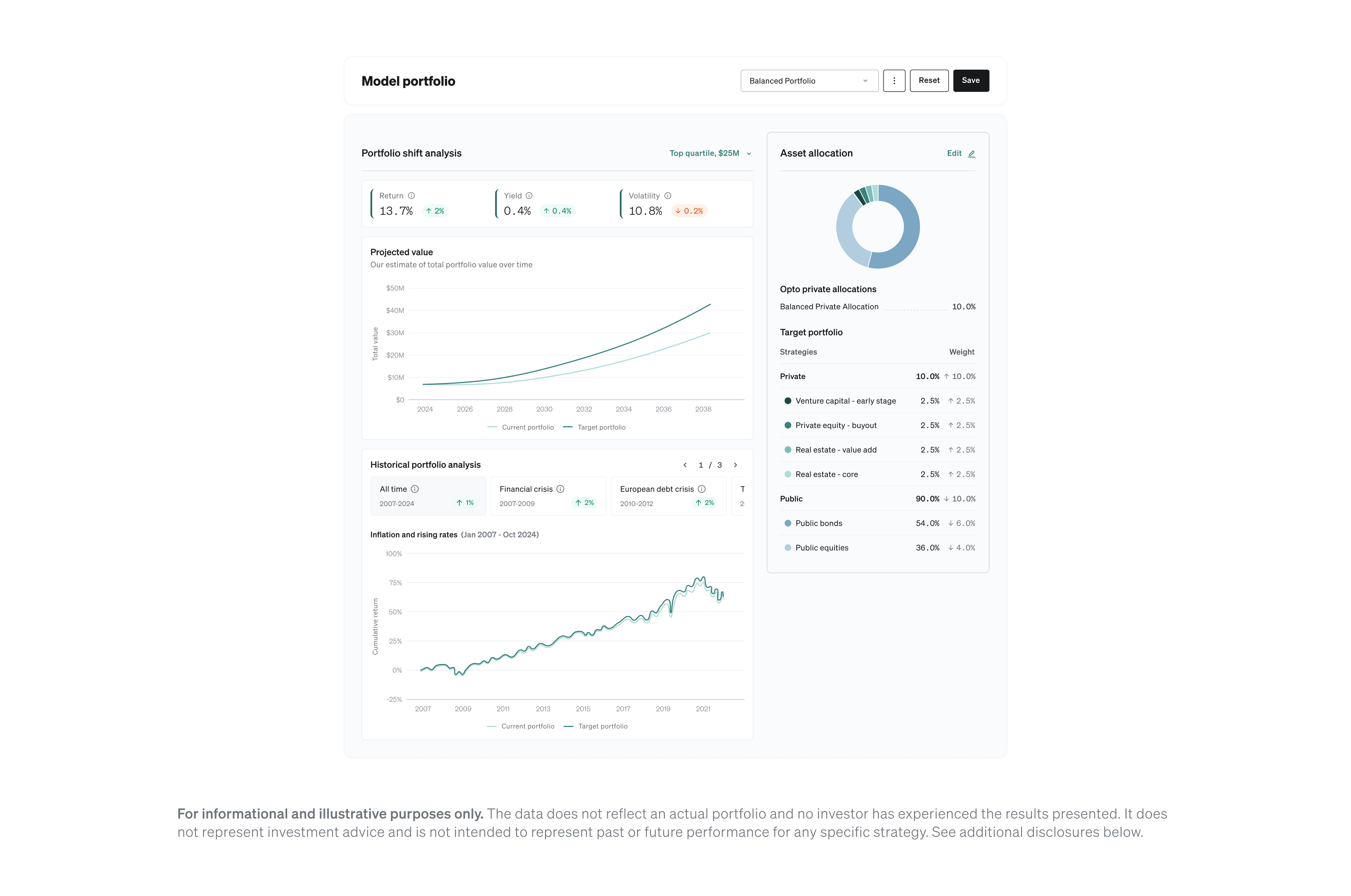

Building a program in the CIO workspace

The first of these unlocks is the simplicity with which investment decision-makers can build private markets programs in Opto’s CIO workspace (released earlier this year).

Key features

Private Allocation tool

- Configure holistic, diversified private asset allocations

- Quickly understand their characteristics

- Embed private allocations within broader model portfolios

- Analyze their interactions with public assets

- Set appropriate long-term exposures for different client profiles

Pacing tool

- Produce annual commitment schedules aligned with long-term private asset targets

- Analyze cash flow and liquidity implications of different pacing strategies

The result is a bespoke, multi-vintage program CIOs can implement through our proprietary fund solutions.

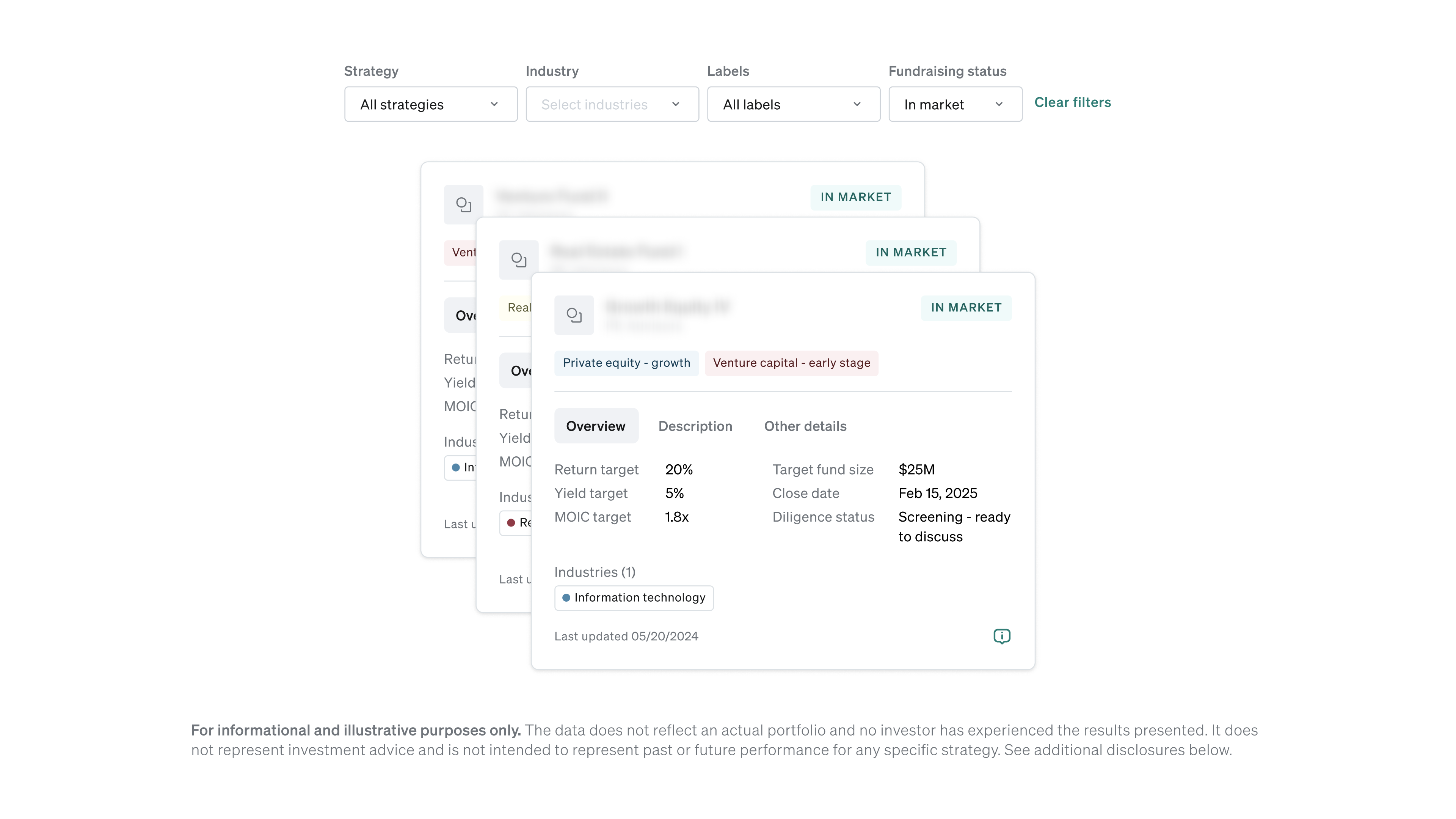

A digitally-enhanced investment partner

The second unlock is our diligence toolkit, which enables CIOs to research prospective investments and collaborate with Opto’s team to evaluate their potential.

New feature: Fund Explorer

- Browse the set of investments tracked by Opto

- Evaluate which ones may be a fit for their private investment program

- Add independently identified investments

- Compare opportunities to benchmarks or other tracked investments

With our diligence notes feature, users can:

- Share questions or analysis requests within Opto’s application

- Leverage our team’s insights during their diligence process

By equipping CIOs with both broad data and rich analysis on potential private investments, our goal is to help them feel as confident as possible in their investment selections.

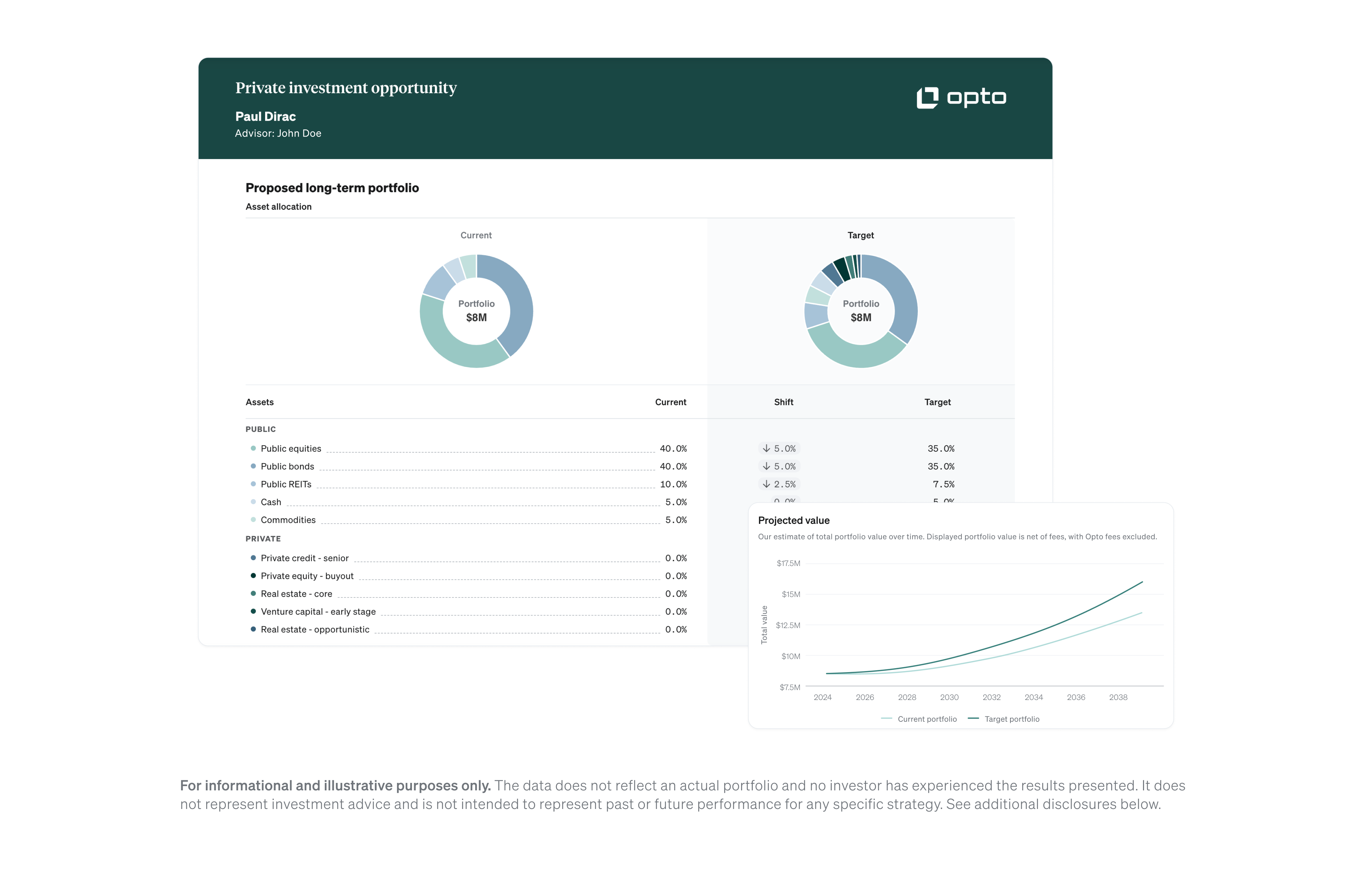

Individualized financial planning with private assets

The third unlock is the ability for advisors to create individualized private allocation plans uniquely suited to each client’s needs.

Key questions answered:

- What’s the right private markets exposure to target?

- How should they get there?

- How much should they commit today?

- How do these decisions affect their long-term goals or liquidity needs?

Planner feature

Developed this year in collaboration with our RIA partners, Opto’s Planner feature empowers advisors to:

- Answer client-specific questions with analytically rigorous private investment plans

- Present these plans to clients through clear, elegant proposals automatically generated by our software

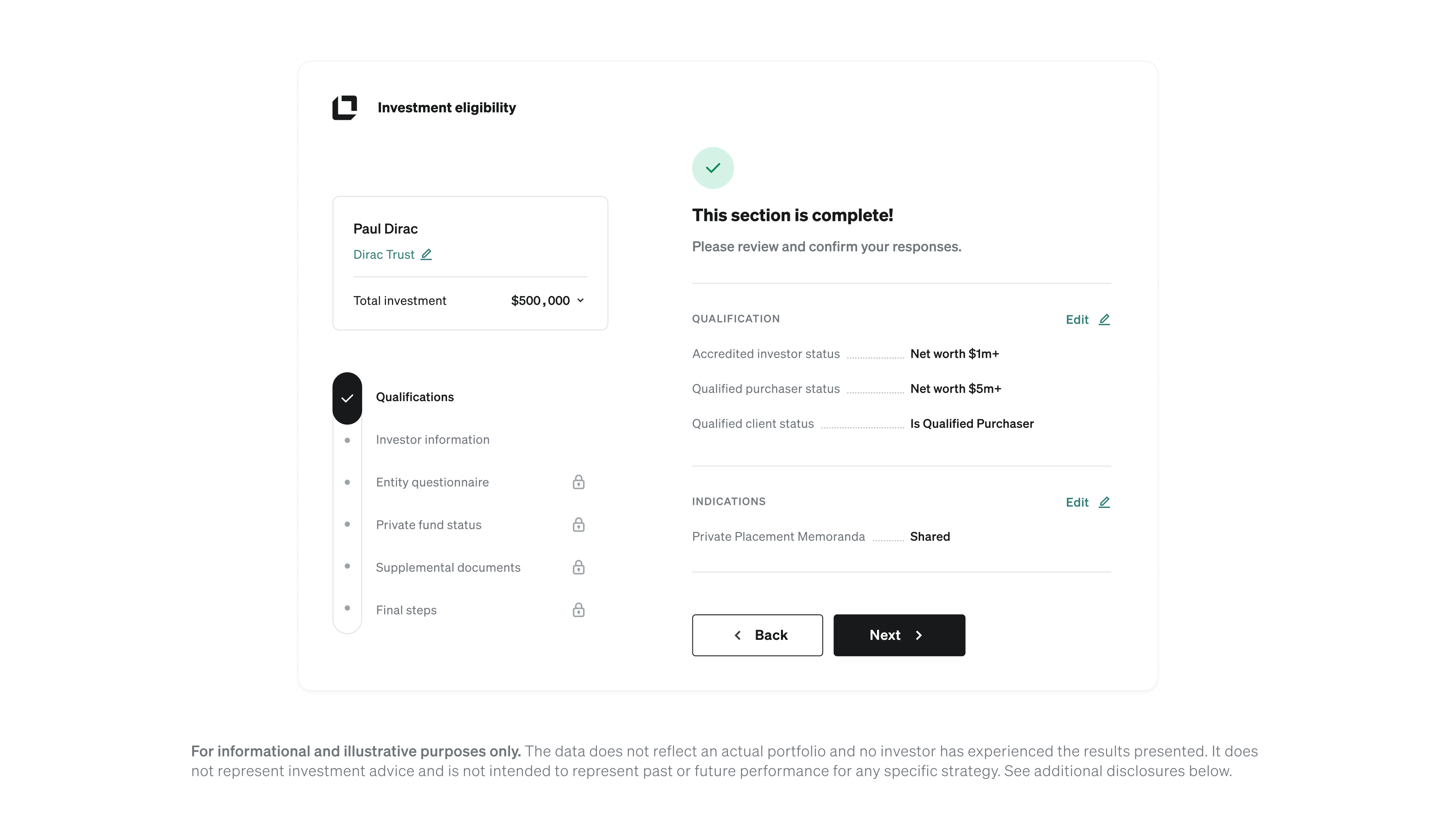

All about ops

In addition to these new analytics-powered workflows, our engineering team has made great progress in automating and streamlining operations for private markets investing.

Ops-oriented enhancements:

- Client data imports

- Subscription workflow upgrades

- Automated capital call tracking

- Detailed monitoring of private asset holdings

- Enhanced admin tools for greater transparency on:

- Fundraising activity

- Program-level investment performance

As ever, our partners emphasized the importance of streamlined transaction processing, investment servicing, and reporting for private assets.

Looking ahead

In 2024, we made immense progress in building software that enables wealth management firms to approach private markets in brand new ways.

I want to thank our RIA partners for engaging so thoughtfully with our team and providing invaluable insights over the course of the year.

I’d also like to thank Opto’s engineering, product, and design teams for their unparalleled dedication to supporting our partners through technology.

While we achieved a lot in 2024, we are in the early days of our journey, and our 2025 product roadmap portends even more exciting developments (stay tuned).

If you have ideas for additional functionality or would like to share challenges (or opportunities) related to private markets investing, we’d be thrilled to hear them and collaborate with you on solutions in the new year.

If you’d like to join the team and build the future of private markets, we’d love to learn more about you and hear why you’d be a great fit.

For disclaimers, visit https://www.optoinvest.com/disclaimers.